-

Hotel Sheraton Levent 4, Istanbul (next to Saphirre Shopping center), Levent, Büyükdere Cd. 3-4 4, 34330 Kâğıthane/İstanbul, Türkiye

- 16.05.2025. (Friday), 08:00 - 23:00

- 17.05.2025. (Saturday), 08:00 - 23:00

- 18.05.2025. (Sunday), 08:00 - 23:00

- 19.05.2025. (Monday), 08:00 - 23:00

- 20.05.2025. (Tuesday), 08:00 - 23:00

- 21.05.2025. (Wednesday), 08:00 - 23:00

- 22.05.2025. (Thursday), 08:00 -12:00

During Easter, Labor day and Independence day holidays Umbrella offices will not work on 18 & 21 April and on 1, 2, 21, 22, 23 May 2025 year.

From October 1, 2024, the minimum salary in Montenegro, in net amount, can not be lower than 600€

The Europe Now 2 program defines a lower contribution rate for pension and disability insurance, which reduces the total amount of taxes and contributions for the minimum wage from 118€ to 78€ per month.

The minimum salary with this program, in the net amount, cannot be lower than 600€ for employees in workplaces up to the fifth level of education qualification, or 800€ for employees in workplaces with the sixth and higher education qualification level.

Umbrella representatives will be available for meetings in Istanbul (Türkiye) on 05/ 06/06/ 07/ 08/ 09/ 10/ 11/ 12. December 2024.

From 1st January 2025 year, a new reduced VAT rate of 15% is being introduced, while the scope of the existing reduced VAT rate of 7% is changing.

On September 6 2024, the Parliament of Montenegro adopted a changes in the field of VAT tax. These changes were published in the Official Gazette of Montenegro no. 88/2024 of September 13, 2024. by which new reduced VAT rate of 15% is being introduced, while the scope of the existing reduced VAT rate of 7% is changing.

Products and services that directly affect the standard of living of citizens will continue to be taxed at a reduced rate of 7%. However, certain products and services that were previously taxed at a rate of 7% will now be taxed at a new reduced rate of 15%.

The new reduced rate of 15% will also be applied as a single rate for taxation of accommodation services in hotels, motels, tourist settlements, guesthouses, camps, tourist apartments and villas, as well as for the preparation and serving of food, drinks and beverages, except alcoholic beverages, carbonated and non-carbonated drinks with added sugar, and coffee, in facilities for catering services.

The scope of products and services for reduced VAT rates is given below: Rate 7%: basic products for human consumption, medicines, orthotic and prosthetic devices as well as medical devices that are surgically implanted in the body, textbooks and teaching aids, drinking water (except bottled), daily and periodicals, public hygiene services, services public transportation of passengers and their personal luggage, funeral services, animal feed, means of nutrition and protection of plants, seed and planting material and live animals, menstrual products and diapers for babies.

Rate 15%: books, monographic and serial publications, accommodation services in hotels, motels, tourist settlements, guesthouses, camps, tourist apartments and villas, services for preparing and serving food, drinks and beverages, except for alcoholic drinks, carbonated and non-carbonated drinks with the addition sugar and coffee in establishments for the provision of catering services, copyright and services in the field of education, literature and art, copyright in the field of science and art objects, services that charge through tickets except for those for which VAT exemption is prescribed, services for the use of sports facilities for non-profit purposes, service services provided in marinas, solar panels (plates), hairdressing services.

II Changes to the VAT zero rate:

The zero rate of VAT on the delivery of products and services for the construction and furnishing of a five-star or more catering facility, an energy facility for the production of electricity with a power of more than 10 MW and the capacity for the production of food products whose investment value exceeds 500,000 euros is abolished.

III Other changes:

- In order to comply with Directive 2009/132/EU, the scope of products that are exempted from payment of VAT upon import is expanded;

- Exemption from paying VAT when importing products in shipments of insignificant value up to 75 euros is abolished.

- The amount of the flat fee that the farmer receives based on the turnover of agricultural and forest products, i.e. services, is increased from 5% to 8%

Deadline for Real Owners Registration is 30.08.2024.

According to Law on the Prevention of Money Laundering and Financing of Terrorism every company owner should do registration of real owners by which they should give a statement (under criminal and financial responsibility) who is real owner of the company.

Based on Article 15, paragraph 1 of the Law on the Prevention of Money Laundering and Financing of Terrorism, companies, legal entities, associations, institutions, political parties, religious communities, artistic organizations, chambers, trade unions, employers' associations, foundations or other business entities, legal entities that receive, manage or distributes funds for specific purposes, a foreign tourist, foreign institution or similar subject of foreign law, who receives, manages or distributes assets for specific purposes, are obliged to enter information about real owners and changes in ownership in the Register of Beneficial Owners.

The person authorized to enter data into the Register enters or updates data via the Internet application by using digital token, in accordance with the law regulating electronic identification and electronic signature.

This statement should be done only by person authorized to represents company and nobody else can do instead.

How to do this? Using digital signature token (qualify electronic signature) and following these Registration Real Owners Instructions

Alternatively Umbrella office can help you with making this report, using your presence (online is enough) and your digital signature token (it cost 80€) and additional cost of 30€+vat.

Amendments to the law on real estate sales tax

Amendments to the law on real estate sales tax from January 1, 2024 introduce progressive sales taxation immovable property as follows:

- Turnover of real estate up to 150,000 euros is taxed at the rate of 3%,

- Real estate turnover in the range of 150,000 euros up to EUR 500,000 is taxed at a rate of 5%.,

- Real estate transactions above 500,000 euros are is taxed at a rate of 6%.,

The Parliament of Montenegro on 11.12.2023. adopted the Law on Prevention of Money Laundering and Financing of Terrorism

With the new Law, more than half of the members underwent changes, as the need for harmonization and adjustment with international standards in the field of preventing money laundering and terrorist financing, as well as with European Union standards (the so-called Fifth EU Directive) and other acts of the UN and the Council of Europe.

Some of the main novelties introduced by the Law relate primarily to the following:

- New obligees of the Law, among existing obligees (such as banks, investment funds, brokers, insurance companies, investment companies, real estate sales and brokerage, factoring companies, audit companies, authorized auditors, accounting and provision tax consulting services, provision of services during the establishment of legal entities and other business companies, as well as property management companies for third parties), companies for mediation in the rental of real estate in transactions where the monthly rent is EUR 10,000 or more and companies for the construction of housing business facilities;

Newspapers that also refer to the measures of knowing and monitoring the client's business, as well as the limitation in dealing with cash and the obligation to report to the financial intelligence unit for each cash transaction in the amount of EUR 15,000 or more or non-cash transaction in the amount of EUR 100,000 or more , without delay, and at the latest within three working days from the date of execution of the transaction;

The new law provides for the formation of a Register of politically exposed persons, where the financial intelligence unit, taxpayers and supervisory authorities will have immediate electronic access to the data;

Also, the newspaper refers to the obligations that taxpayers have in reporting to the financial-intelligence unit, and in the part of supervision over the application of the Law by supervisory authorities, indirect supervision has been introduced, which is carried out by controlling data, information and documentation that taxpayers submit to the competent supervisory authority.

For residence and work permit renewal 450€ salary and 118,07€ social contributions are mandatory

According to recent Montenegro police decision and article 43 foreigner law every foreigner can not get salary lower then 450€ and pay social contributions to the government less then 118,07€ monthly.

Amendments to the law on corporate income tax, starting from March 18, 2023.

They are exempt from withholding tax executed on the basis of a loan, i.e. a loan which the corporate income tax payer performs against natural persons who do not have the status of a related person up to the amount of 5,000 euros per year.

A special withholding tax rate of 30% is introduced on income paid to a non-resident legal entity which is established or has its registered office or has seat of administration or place of actual administration in the territory with tax sovereignty.

This provision does not apply to a non-resident person who has the status of resident in the country with which Montenegro has concluded an avoidance agreement double taxation.

Additionally, a person that is established or has registered headquarters or has a seat of administration or a place of actual administration in the territory with tax sovereignty is considered by a related person of the tax resident of the income payer.

It is exempted from paying corporate income tax beneficiaries of incentive measures for the development of research and innovation in accordance with the law governing them incentive measures for the development of research and innovation.

A new provision is introduced which defines that they are transactions between permanent business units and non-resident headquarters and business units subject documentation on transfer prices.

DIGITAL NOMAD RESIDENCE PERMIT PROGRAM OFFICIALLY STARTED IN DECEMBER 2022.

The Ministry of Internal Affairs of Montenegro is in session from 02.12.2022. adopted the rulebook on the conditions for obtaining a residence permit for digital nomads. Digital nomads who have a work engagement contract electronically with a foreign company or their own company registered outside Montenegro with a minimum income of €1,350 per month have the possibility of obtaining a digital nomad residence permit with a maximum validity of two years.

To be able to apply for residence permit digital nomads should provide:

- 1. Contract with foreign company with minimum salary of 1350€,

- 2. Proof of accommodation in Montenegro,

- 3. Registration document (tax extract) of foreign company,

- 4. Health Insurance on 30 days,

- 5. Proof that his employer (foreign company) register him/her as official worker and that pay social insurance for him/her,

- 6. Criminal record file from county of origin,

- 7. Passport valid for all period of required residence,

- 8. Registration in touristic office in 24 hours after he/she entered in Montenegro

The deadline for submitting requests for payment of debt in installments is June 30, 2022.

Debt payment to the tax administration can be made in installments (maximum 60 installments).

The deadline for submitting requests for payment of debt in installments is June 30, 2022.

Montenegro presented the EUROPE NOW programm

On 29th December 2021, Montenegrin Assembly passed a series of laws that are part of the Europe Now programme, which sets the strategy of Montenegro’s economy policy-achieving smart, sustainable and inclusive economic growth.

Series of laws that were changed in order to make programme Europe Now possible include: Labor Law, Law on Personal Income Tax, Law on Corporate Income Tax, Law on Value Added Tax, Law on Tax Administration, Law on Mandatory Social Security Contributions. Also, new laws were passed: Law on compulsory health insurance, Accounting Law. All changes and new laws are in effect from 1st January 2022.

Programme Europe now provides for the following main changes:

- Increase of the minimum wage from EUR 250.00 to EUR 450.00 in net amount;

- Reduction of costs for employers through lower tax burden on labor;

- Introduction of higher personal income tax rate on 15%;

- Introduction of progressive corporates tax rate (from 9 till 15%) as a more efficient model of taxation;

- Introduction of the non-taxable part of the salary of EUR 700.00 on the gross basis (rate income tax of 0% on a gross basis of up to EUR 700.00);

- Introduction of an increased income tax rate of 15% on the gross base above EUR 1,000.00;

- Abolition of the obligation to pay contributions for compulsory health insurance.

The amounts of the tax rate on income from self-employment have also been changed, so that now the amount of taxable income from EUR 8,400.01 to EUR 12,000.00 is taxed at a rate of 9%, while the amount of taxable income is higher than EUR 12,000.00.

For all revenues generated from income from property, capital, capital gains, revenues from sports activities, copyrights and related rights, patents, the tax rate has been increased from 9% to 15%.

When it comes to income generated based on economic activity, liberal professions, professional services, service agreements, tax is paid at a rate of 9% for amounts up to EUR 12,000.00, while for amounts over EUR 12,000.00 tax rate is 15%.

In addition, non-resident natural persons will pay tax for income earned in Montenegro, unless they earn:

- income from performing activities electronically with an employer who does not perform activities in Montenegro; and

- earnings higher than three average gross earnings earned in the previous year in Montenegro, according to the data authority in charge of statistics.

The right to exemption from income tax is exercised by the beneficiary of incentive measures for the development of research and innovation, in accordance with the law governing incentive measures for the development of research and innovation.

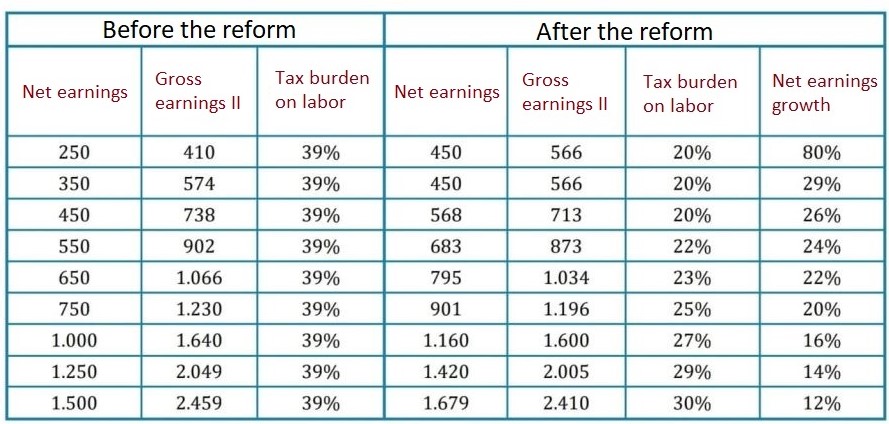

In essence, with the programme Europe Now the tax burden on wages will be reduced from 39% to 20.4% for the lowest amounts of income, which are then progressively increased to a level of 31.3% for the highest amounts of net salaries of EUR 2,000.00 and up.

Europe Now also introduces progressive rates on the profit of legal entities amounting to 9%, 12% and 15%, mainly depending on the amount of taxable profit instead of the proportional corporate income tax rates of 9% that were applied so far.

Tax rates on the amount of taxable profit are:

- up to EUR 100,000.00 – 9%;

- from EUR 100,000.01 to EUR 1,500,000.00: EUR 9,000.00€ + 12% on the amount over EUR 100,000.01;

- over EUR 1,500,000.01: EUR 177,000.00€ + 15% on the amount over EUR 1,500,000.01. In addition, deductible tax is increased from 9% to 15% based on gross income.

More details on: Montenegro government website

Source: Karanovic & Partners

As part of the "Europe Now" project, Montenegro has introduced a progressive corporate income tax rate starting from January 1, 2022.

In accordance with the amendment to the Law on Corporate Income Tax, a decision was made to instead

proportional corporate income tax rates of 9%, introduce progressive rates on

profit of legal entities amounting to:

- 9% (up to EUR 100,000),

- 12% (from EUR 100,000.01 to EUR 1,500,000: EUR 9,000+ 12% on the amount over

100,000.01 euros;

) and

- 15% (over 1,500,000.01 euros: 177,000 euros + 15% on the amount over 1,500,000.01 euros.), depending on the amount of taxable profit.

More details on: Montenegro government website

The economic citizenship program is extended for an additional 12 months

According to the decision of the Government of Montenegro at the electronic session on December 30, 2021. year, the program of economic citizenship is extended for an additional 12 months.

The extended program implies stricter conditions, which means that all investors will have to submit a bank guarantee in the amount of 50 percent of investments to the government within a month. In addition, those who will apply for citizenship in addition to the 100,000 euros they have had to pay into the special Fund for the Development of Underdeveloped Municipalities, will now have to allocate an additional 100,000 euros to the Innovation Fund.

More details on: Montenegro government website

From January 2022, the lowest full-time salary in Montenegro is 450 euros.

On December 29, the Parliament of Montenegro adopted the budget for 2022 worth almost two and a half billion euros.

Within the framework of the Budget Law, the economic program "Europe Now" was adopted, according to which the minimum salary of employees in Montenegro from January 2022 will amount to 450 euros instead of the current 250.

Employee health insurance contributions have been abolished. The non-taxable part of the salary will be up to 700 euros, and the tax on salaries over 1,000 euros has been increased from nine to 15 percent.

Review of new and old net and gross salaries

During New Year and Christmas holidays, Umbrella office will be closed from 4:00 pm Thursday 30rd of December 2021 and will re-open 8:00 am on Monday 10th of January 2022

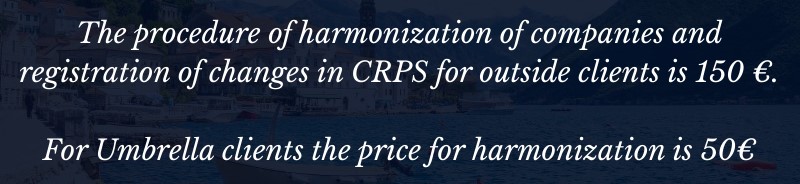

Last notice! The deadline for harmonizing the company's acts with the new company law expire on 11.01.2022.

On January 11, 2022, the deadline for harmonizing the company's acts with the new law on companies expires. All LTD/LLC who are registered before 11.07.2020. year and who have not harmonized the company's acts with the new law must do so by 11.01.2022, otherwise non-compliance with the provisions or non-compliance with the prescribed deadlines will be sanctioned as an economic offense that entails penalties and criminal liability.

With a power of attorney, residence and work permit or temporary residence may be taken over by another legal or natural person

According to the Ministry of Police recent decision, from 19.11.2021. applicant who filling the application for residence and work permit or the temporary residence permit, may authorize the employer or another legal or natural person to take over the residence and work permit or the temporary residence permit, or another decision on the application on his behalf.

Diploma nostrification required

According to the Ministry of Police recent decision every foreign employee who apply for residence and work permit should present nostrification of diploma (elementary, high school or university).

Also, any foreign employee who did not submit a nostrified diploma during the procedure for obtaining a residence and work permit must do so during the procedure for renewal of the residence and work permit.

The nostrified diploma should be submitted by foreign citizens who are employed in the Montenegrin legal society. Foreign nationals who only have a residence permit (not work permit) do not have to submit a nostrified diploma.

- For elementary school diploma it is necessary to bring original diploma (notarized and apostilled), do translation on Montenegro language, pay 30€ nostification tax and submit it to Ministry of Education.

- For high school diploma it is necessary to bring original diploma (notarized and apostilled), do translation on Montenegro language, pay 50€ nostification tax and submit it to Ministry of Education.

- For university diploma it is necessary to bring original diploma (notarized and apostilled) + list of passed exams (notarized and apostilled), to do translation on Montenegro language, pay 100€ nostification tax and submit it to Ministry of Education.

From October 1st, 2021 the minimum wage can not be lower than 250€. From 4th June 2021, limit for VAT registration changed from 18,000€ to 30,000€

According to new labor law (04.06.2021), from October 1st, 2021 the minimum wage can not be lower than 250€. This will be reflected in the level of employee contributions as well. From 1st October employee contributions for minimum wage instead of 142,04€ will be 159,97€ for full-time and instead of 71,02€ will be 79.99€ for part-time.

According to new VAT law (04.06.2021), limit for VAT registration changed from € 18,000 to € 30,000, Source.

Mass vaccination will begin on Tuesday (04.05.2021) at over 140 points in Montenegro

As of tomorrow, mass vaccination against COVID-19 will be organized at more than 140 points in all Montenegrin municipalities.

Citizens and foreigners with residence and residence and work permits, will be able to choose between vaccines that will be available at that time

Mass vaccination will begin with the Chinese Sinofarm vaccine.

Registration for vaccination is not necessary, but it is necessary to bring an identification document. Source

All owners of legal entities and businessmen are obliged to harmonize the organization with the new Company Law

All owners of legal entities and businessmen are obliged, in accordance with the provisions of Article 329 of the Law on Companies, to harmonize the organization (statute, company bodies and other acts) with this law and register changes within the period provided by this article for various forms of bisiness entities.

Please note that they are obliged to fill in all the missing data on the statement for the business entity in question in the single registration application, so that they can be entered on the last statement from the single CRPS information database.

Also, the applicant under full criminal and material responsibility declares that the data entered in the application are correct, in accordance with the single registration application which is an integral part of the Rulebook on the manner of management and content of the CRPS.

Limited liability companies (public companies and large companies) and Joint stock companies which are registered in the CRPS before the entry into force of this law (11.07.2020), are obliged to harmonize the organization and register the changes by 11.04.2021. years

Other companies registered in the CRPS until the entry into force of this law (11.07.2020) are required to harmonize the organization with this law and register change in CRPS until 11.01.2022. years

Partnerships and entrepreneurs who are not registered in the CRPS until the entry into force of this Law (11.07.2020), are obliged to make an entry in the CRPS in accordance with this law by 11.04.2021. years.

Entrepreneurs who are registered in the CRPS before the entry into force of this law (11.07.2020) are obliged to harmonize their operations and submit a registration application for registration in the CRPS in accordance with this law by 11.01.2021. years. Source

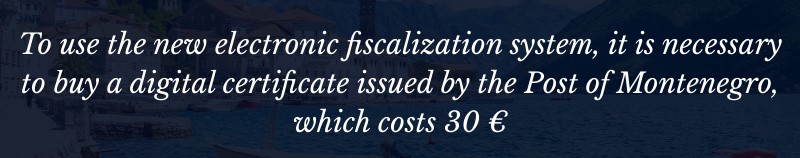

Electronic invoice fiscalization in Montenegro starting from 01.01.2021.

The Parliament of Montenegro bring the Law on Fiscalization in the Trade of Products and Services, which provided the legal basis for the implementation of the electronic fiscalization project, which will enable the submission of data on the trade of products and services and fiscal invoices to the Tax Administration in real time.

On the 1st of January of 2021, Montenegro will fully embrace its new fiscal system. Because the system is electronic, the Ministry of Finance and the Tax Authority believe it will speed up the process of digitalization. The transitional period for the implementation of the new system will last until June 1st, 2021, when it will be possible to use the old and new methods of issuing invoices together.

The Tax Administration has said that the establishment of the electronic fiscalization system is aimed at improving the efficiency of the transaction control, which will contribute to the reduction of informal economy, gradual downsizing of tax administration and efficient management of tax controls.

All issued accounts, cash and non-cash, through fiscal service and internet connection are sent to the Tax Administration, which assdicts a unique account code upon receipt of the account and sends it as feedback to the taxpayer, which is also a confirmation that the account has been fiscalized

Practically, this means that all sellers of services or products will have to have a digital certificate, a permanent internet connection and special fixed printers through which they will issue invoices in real time. Each invoice will have to be approved by the tax administration before printing. The verification process itself will take only a few seconds. Source

Payment of subsidies extends for another two months - 15.10.2020.

In accordance with development of the epidemiological situation, as well as with measures and recommendations of the Ministry of Health in relation to limitations regarding performance of economic activities, the Montenegrin Cabinet at today’s session decided, at the proposal of the Ministry of Economy, to extend the Programme of wage subsidy in order to mitigate the negative effects of the novel coronavirus epidemic Sars – Cov- 2 for another two months, i.e. to enable the subsidization of part of the October and November salaries. In line with the measures in force, October salaries will be subsidized to employees in the following activities:

1. Companies and entrepreneurs providing services in activities with codes: 55.10 (Hotels and similar accommodation), 55.20 (Resorts and similar facilities for short stays), 55.30 (Camping, caravans and caravan parks), 79.11 (Travel agency activities), 79.12 (Tour operator activities) and 79.90 (Other reservation service and related activities); companies and entrepreneurs performing the activity of specialized retail trade for the sale of souvenirs; Companies and entrepreneurs who organize excursions, trips and boat trips for tourist purposes - are entitled to subsidies for October salaries in proportion to the earnings, up to a maximum of 70% of the amount of taxes and contributions to the minimum wage and 70% of the net minimum wage.

2. For caterers who perform activities in municipalities where their work is prohibited, October salaries are subsidized in proportion to the earned salary, up to a maximum of 100% of the amount of taxes and contributions to the minimum wage and 100% of the net minimum wage. For caterers operating in other municipalities, October salaries are subsidized in proportion to the earned salary, up to a maximum of 50% of the amount of taxes and contributions to the minimum salary and 50% of the net minimum salary.

3. Companies and entrepreneurs providing services in activities with codes: 49.31 (Urban and suburban land passenger transport), 49.32 (Taxi transport) and 49.39 (Other passenger transport by land), as well as economic entities registered under another by the code of basic activity, which provide services of intercity passenger transport, international passenger transport, limo service, rent-a-car services, as well as services related to bus traffic, are entitled to a subsidy of August and September salaries in proportion to earnings, up to 50 % of the amount of taxes and contributions on the minimum wage and 50% of the net minimum wage.

4. Companies and entrepreneurs performing activities with codes 90.01 (Performing arts), 90.02 (Ancillary activities within performing arts), 90.03 (Artistic creation), 90.04 (Work of art institutions) and 59.14 (Film screening activities), and whose activities related to the organization and performance of concert, festival, film and theater programs, as well as music programs in catering and hotel facilities are entitled to a subsidy of October salaries in proportion to earnings, up to 100% of taxes and contributions to the minimum wage and 100% net minimum wage.

5. Companies and entrepreneurs whose activity is related to the organization of events whose holding is prohibited (agencies for organizing events, wedding dress salons, etc.) are entitled to a subsidy of October salaries in proportion to earnings, up to 100% of taxes and contributions to the minimum wage and 100% of the net minimum wage.

6. Companies and entrepreneurs that provide ancillary services in activities related to the organization of events whose holding is prohibited ( photographic services, etc.) are entitled to a subsidy of October salaries in proportion to the earned earnings, up to a maximum of 50% of taxes and contributions to the minimum earnings and 50% of the net minimum wage.

7. Employees who, by order of the Ministry of Health, in order to suppress the epidemic, certain quarantine or self-isolation measures are entitled to subsidies for October salaries under the same conditions as in the period July-September.

8. Subsidies for new employment are applied under the same conditions as in the period July-September.

9. Subsidizing paid leave to parents of children under the age of 11 will be defined by amending this information after a special order has been issued to address this issue.

The list of activities and the conditions for subsidizing November salaries will be determined by the Government later, in accordance with the development of the epidemiological situation in the country.

In addition, companies and entrepreneurs who meet the conditions defined by the Program for obtaining subsidies, and who for any reason were late to apply for the July and August subsidies within the originally set deadlines, are granted an additional deadline for applications in the period from 20 October to 31 October 2020.

Source.

Law on amendments to the law on value added tax entry into force - 06.08.2020.

Amendments to the law prescribe the application of a reduced VAT rate of 7% for the following services:

- - Accommodation in tourist apartments, in addition to previously prescribed other types of tourist accommodation - hotels, motels, tourist resorts, boarding houses, camps and villas,

- - Preparation and serving of food, beverages and beverages, except alcoholic beverages, carbonated beverages with added sugar and coffee, in facilities for the provision of catering services.

Also, the amendments to the Law on stipulate that VAT will be paid at the rate of 0% on:

- - Deliveries of products, ie services on the basis of a concluded donation agreement with state bodies and organizations and bodies of the local self-government unit and other public legal bodies,

- - Delivery of donations in the form of medical devices and protective equipment to state bodies and organizations and bodies of the local self-government unit and other public legal bodies, in order to suppress the consequences caused by epidemics of infectious disease.

This measure applies to all types of catering facilities registered in accordance with the Law on Tourism and Hospitality, and is applied from 04.08.2020. until August 31, 2021.

In addition to changes in tax rates, the amendments to the Act introduced the obligation to submit a monthly VAT return exclusively electronically, 3 months from the date of entry into force of the Act. One of the novelties brought by the Law refers to the standardization of electronic invoices as proof of the turnover of products or services. Source.

Russia and Azerbaijan on "green list" - 04.08.2020.

At the session of the National Coordination Body for Communicable Diseases, chaired by President Milutin Simović, the list of countries whose residents can enter Montenegro was updated, so that residents of the Russian Federation and the Republic of Azerbaijan will be allowed to enter Montenegro without additional conditions

The Operational Staff for the Tourism Economy suggested, among other things, to the National Coordination Body, adding the Russian Federation and the Republic of Azerbaijan to the "green list" of countries whose residents can enter Montenegro without other conditions, and that the National Coordination Body consider the further liberalization on entry into Montenegro, for residents of the Western Balkan countries.

The National Coordination Body for Communicable Diseases assessed, while considering the epidemiological situation in the countries of our surroundings, and especially the reliability and relevance of available data, as well as the needs of our tourism industry and the national interests of Montenegro, that there are no obstacles for liberalization on the entry of Russian and Azerbaijani residents, until the decision on residents of the surrounding countries has been extended, while the Public Health Institute submits an epidemiological risk assessment for Montenegro on the basis of the liberalization on the entry of residents of the surrounding countries, for each country individually. Source.

New Law on Business Organizations in Montenegro Entered into Force

The new Montenegrin Law on Business Organizations entered into force in July 2020. The reason for establishing the Law is directly related to the process of Montenegro’s accession to the European Union. The key criteria for the temporary closure of negotiations in Chapter 6 (Commercial law) is precisely the adoption of the Law. Additional goal is the full harmonization of the Law is with the so-called “Company Directives”.

Major Novelties are: Companies of Public Interest, Subsidiary, Breaking the corporate veil and the creditor’s lawsuit for collection of claims, Address for receiving e-mail, Procure, Special duties to company and lawsuits for breaching such duties, Company assets and capital, Entrepreneur and manager...please read Major Novelties.

Third package of economic measures - Incentives for innovative activities

Montenegro opens new opportunities - a wide range of benefits and incentives for the development of innovative economy and startup companies, offers the same conditions for domestic and foreign companies and thus becomes an attractive destination for technological entrepreneurship and testing of new technologies. The measures of the third package related to strengthening the IT economy, which include a financial package of EUR 30 million for the period 2020-2024 in direct partnership between the Government of Montenegro and the domestic business sector with foreign direct investment.

The following measures:

- Establishment of the Montenegrin Strategic IT cluster - EUR 300,000

- Establishment of the Center for e-commerce support - EUR 150,000

- Establishment of an Innovation Centre with virtual and augmented reality technologies - EUR 25.5 million

- Support to the economy through subsidizing salaries, including tourism in the total amount of EUR 16.2 million

- Innovations in the public sector - EUR 339,000

- Continuous support to innovative startups - EUR 500,000

The measures aim to make the IT sector a new strong industry, with high export potential; that IT economy and digitalization become catalysts for the development of an innovative economy that will strengthen our traditionally strong industries (energy, tourism and agriculture) and which will support digital transformation of Montenegro. Source.

Prime Minister presents third package of Government measures to support citizens and economy

Prime Minister Duško Marković said that the Government had adopted a third package of economic measures to support citizens and the economy to mitigate the effects of the coronavirus pandemic. The package is worth EUR 1.22 billion and covers a four-year period.

The third package of measures will include, the Prime Minister announced, certain short-term, and long-term measures. The purpose of short-term measures is to provide

- Support to the tourism sector in the amount of EUR 83,350,000;

- Incentive for agriculture and fisheries for the realization of investments in the total amount of EUR 89.4 million

- Improvement of the competitiveness of the economy through 17 program lines and EUR 10 million worth grants in 2020 alone

- Support to the economy through subsidizing salaries, including tourism in the total amount of EUR 16.2 million

- Support to the most endangered categories of the population in the amount of EUR 1.8 million

"So, within the intervention approach, we will again subsidies salaries and save our employees, reschedule loans and reduce the VAT rate from 21% to 7% on the preparation and serving of food and non-alcoholic beverages in hospitality industry for a period of one year" - said Prime Minister Duško Marković. Find out more.

Salary subsidies continue, numerous economy support programmes begin

Through the third package of short-term measures, the Ministry of Economy will start with the salary subsidies from 1 August. EUR 18 million are planned by the end of the year. In the next three months, subsidies will be awarded for employee salaries in the amount of 50-100% of the minimum gross salary, as follows:

- Suspended industries 100%

- Tourism 70%

- Hospitality industry 50%

- Road transport 50%

- Quarantine and self-isolation 50%

- Parents of children up to 7 years 50%.

- To support new employment for 6 months, we will subsidies 70% of salary.

Furthermore, as a non-refundable support to the economy, we have allocated EUR 10 million for the Programm for improving the competitiveness of the economy, which includes 17 programm lines. Through support measures, we also provided interest-free loans for energy-efficient home for households. That project will start on 1 October, the Minister said. Find out more.

Foreigners' documents are valid until 7 October

Application of the measure by which state bodies, state administration bodies, local self-government and local administration bodies, companies, public institutions and other legal entities, entrepreneurs and natural persons were obliged to issue permanent residence permits, temporary residence permits and temporary residence and work permits for foreigners, which have expired, on the basis of which they exercise some of their rights or perform an obligation before those bodies, and which were considered as valid until 30 September, has been extended until 7 October 2020.

Measures whose application has been extended for a certain period may be reconsidered after the expiry of those periods and their application may be extended again, Source.

Wearing protective masks outdoors and indoors is mandatory throughout Montenegro

Wearing protective masks outdoors and indoors is mandatory throughout Montenegro, including children older than 7 years, except on beaches and in national parks, provided that physical distancing and previously prescribed measures are respected.

The gathering of persons is limited in the entire country to a maximum of 40 persons in outdoor public places, and to 20 persons in closed public places, with the obligation to maintain a physical distance of at least two meters. (This obligation does not apply to residential buildings.).... Source.

Montenegro celebrates July 13th – Statehood Day

In Montenegro July 13th is celebrated as Statehood Day, because on that day in 1878 Montenegrin independence was recognized at the Berlin Congress and on the same date in 1941 nationwide anti-fascist uprising was launched. Because of this holiday Monday (13th July) and Tuesday (14th July) are non-working days. In this period Umbrella office will be closed but coworking and meeting room will be available 24/7 for all our clients.

Montenegro celebrates July 13th – Statehood Day - 10.07.2020

In Montenegro July 13th is celebrated as Statehood Day, because on that day in 1878 Montenegrin independence was recognized at the Berlin Congress and on the same date in 1941 nationwide anti-fascist uprising was launched. Because of this holiday Monday (13th July) and Tuesday (14th July) are non-working days. In this period Umbrella office will be closed but coworking and meeting room will be available 24/7 for all our clients.

UK, UAE, Turkey, Ukraine and Belarus on the "green list"

The National Coordination Body for Communicable Diseases has decided, at the suggestion of the Public Health Institute, to allow British residents to enter Montenegro without any additional conditions, i.e. to include the United Kingdom on the "green list" of countries which includes, among others, EU Member States.

Respecting the economic needs of Montenegro, the National Coordination Body, after discussion with the competent state epidemiological services and after reaching an agreement on the established measures to control passengers during boarding and disembarkation, decided to allow entry in Montenegro to residents of Turkey, the United Arab Emirates, Ukraine and Belarus who do not show symptoms and signs of coronavirus infection and meet other requirements which will be prescribed by the Ministry of Sustainable Development and Tourism. Source.

Residence permits for foreigners are valid until 30 September

The National Coordination Body, at the suggestion of the Police Administration, decided that expired residence permits for foreigners in Montenegro are considered as valid until 30 September 2020, if the person to whom the permit applies meets all other legally prescribed conditions.

It was decided that after the previous similar measures, which were adopted during the epidemic, and following today's measure, the validity of the residence permits of foreigners after 30 September will not be extended, in this way. Source.

Montenegro opens its borders to EU countries

Appreciating today's decision of the EU Council on the coordinated opening of borders of the European Union member states towards third countries, the National Coordination Body decided that Montenegro should allow the entry of EU residents, without additional conditions. When deciding, the facts about high epidemiological standards and quality health infrastructure of the European Union countries, were also taken into account. Residents of the European Union countries are allowed to enter Montenegro through countries which are not EU member states, but exclusively if they use those countries only as transit countries, or if they do not stay in those countries, as evidenced by the inspection at the time of entry/exit from those countries.

The National Coordination Body for Communicable Diseases will decide subsequently on the opening policy towards other countries. When deciding, all relevant epidemiological parameters in each country such as the number of active cases of infection, the trend and prevalence of active cases, and the overall response of each country to COVID-19, including available information on testing, monitoring, contacts monitoring, treatment, reporting, as well as the reliability of information, will be taken into account. Source.

MEASURES IN FORCE - updated on 9 July:

Appreciating today's decision of the EU Council on the coordinated opening of borders of the European Union member states towards third countries, the National Coordination Body decided that Montenegro should allow the entry of EU residents, without additional conditions. When deciding, the facts about high epidemiological standards and quality health infrastructure of the European Union countries, were also taken into account. Residents of the European Union countries are allowed to enter Montenegro through countries which are not EU member states, but exclusively if they use those countries only as transit countries, or if they do not stay in those countries, as evidenced by the inspection at the time of entry/exit from those countries.

The National Coordination Body for Communicable Diseases will decide subsequently on the opening policy towards other countries. When deciding, all relevant epidemiological parameters in each country such as the number of active cases of infection, the trend and prevalence of active cases, and the overall response of each country to COVID-19, including available information on testing, monitoring, contacts monitoring, treatment, reporting, as well as the reliability of information, will be taken into account.

Montenegro opens its borders to EU countries

Appreciating today's decision of the EU Council on the coordinated opening of borders of the European Union member states towards third countries, the National Coordination Body decided that Montenegro should allow the entry of EU residents, without additional conditions. When deciding, the facts about high epidemiological standards and quality health infrastructure of the European Union countries, were also taken into account. Residents of the European Union countries are allowed to enter Montenegro through countries which are not EU member states, but exclusively if they use those countries only as transit countries, or if they do not stay in those countries, as evidenced by the inspection at the time of entry/exit from those countries.

The National Coordination Body for Communicable Diseases will decide subsequently on the opening policy towards other countries. When deciding, all relevant epidemiological parameters in each country such as the number of active cases of infection, the trend and prevalence of active cases, and the overall response of each country to COVID-19, including available information on testing, monitoring, contacts monitoring, treatment, reporting, as well as the reliability of information, will be taken into account.

Montenegro opens its borders to EU countries

Appreciating today's decision of the EU Council on the coordinated opening of borders of the European Union member states towards third countries, the National Coordination Body decided that Montenegro should allow the entry of EU residents, without additional conditions. When deciding, the facts about high epidemiological standards and quality health infrastructure of the European Union countries, were also taken into account. Residents of the European Union countries are allowed to enter Montenegro through countries which are not EU member states, but exclusively if they use those countries only as transit countries, or if they do not stay in those countries, as evidenced by the inspection at the time of entry/exit from those countries.

The National Coordination Body for Communicable Diseases will decide subsequently on the opening policy towards other countries. When deciding, all relevant epidemiological parameters in each country such as the number of active cases of infection, the trend and prevalence of active cases, and the overall response of each country to COVID-19, including available information on testing, monitoring, contacts monitoring, treatment, reporting, as well as the reliability of information, will be taken into account.